The dominance of the Big Three

The Cavell Conference in London this week brought forward some compelling insights into the world of Unified Communications (UC). The focus was primarily on the three giants in the industry: Microsoft Teams, Cisco Webex, and Zoom. These platforms stand out as the frontrunners in the UC market, leaving less room for other platforms. There is a suggestion that unless these smaller platforms find a niche, perhaps in specific verticals, their longevity in the market is questionable and consolidation will likely occur. An alternative for them could be to leverage the infrastructure of the top three, though this idea might not be readily accepted by all.

Growth predictions and market strategies

Cavell’s global forecast for platforms like Zoom Phone, Webex Calling, and Microsoft telephony is impressive. They predict growth from nearly 40 million users today to a staggering 100 million in the next five years. Interestingly, these forecasts focus solely on cloud-based systems.

Cisco, a market leader in voice systems, has uniquely approached the market by starting with voice and adding UC into their offering, as opposed to Microsoft and Zoom, which are doing the opposite. With 41 million telco voice lines plus a large base of enterprise systems, Cisco’s total voice-enabled UC lines could be significantly higher than Cavell’s forecast.

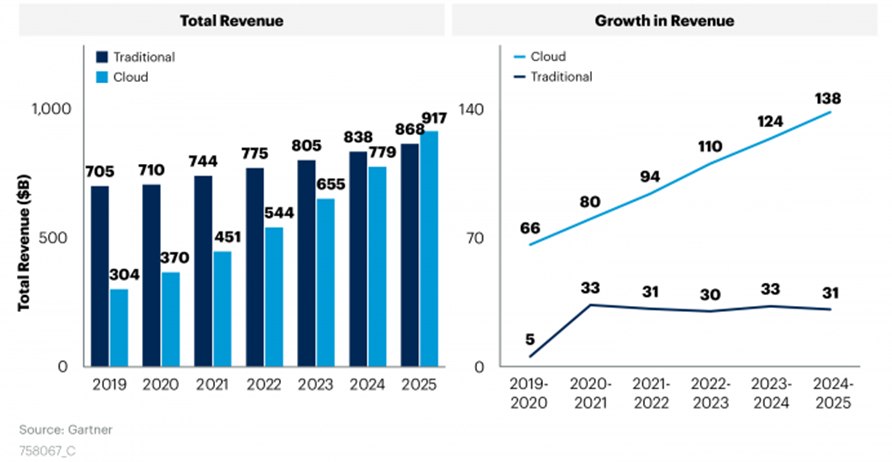

As a side note following predictions have been made by Gartner on the evolution of traditional voice networks:

At many operators, both will co-exist for a long time while the challenges remain: how to bring the services in an efficient way to the market. Simplification and automation are key answers to accelerate the time to market. This is in line with the core services and platforms that Netaxis provides to a growing installed base of leading operators globally.

Job security and market trends

A notable concern discussed was job security hesitancy among telecoms engineers wary of losing control over connectivity infrastructure. However, there’s an optimistic view that these engineers will transition to roles focused on improving customer experience in cloud-based networks. Services and platforms that Netaxis provides to a growing installed base of leading operators globally.

Cisco Webex, currently second in the UC market, has shown impressive growth, outpacing the entire RingCentral base last year. The Service Provider market is crucial for Microsoft, with half of Teams Phone users coming through operators. The integration between Teams Cloud and various IMS Clouds for Teams Phone Mobile, though complex, is gradually progressing.

The shift in enterprise communication

A panel featuring representatives from large enterprises like BSI, Atkins Realis, and Norton Rose Fulbright provided valuable insights. Many enterprises are consolidating their telephony systems, moving towards solutions like Operator Connect. This transition not only simplifies communication but also helps in cost reduction by identifying actual telephony needs within the organization.

The role of AI and new challenges

The integration of AI and sentiment analysis in UC systems poses new challenges. Companies now have to reconsider their communication strategies, including the modification of pre-recorded messages to reflect the use of AI.

Atkins Realis is moving towards eliminating all enterprise equipment, indicating a significant shift towards cloud-based telecommunication. This transition highlights the growing importance of cloud services in managing communication without the hassle of hardware maintenance.

The importance of adaptation and automation

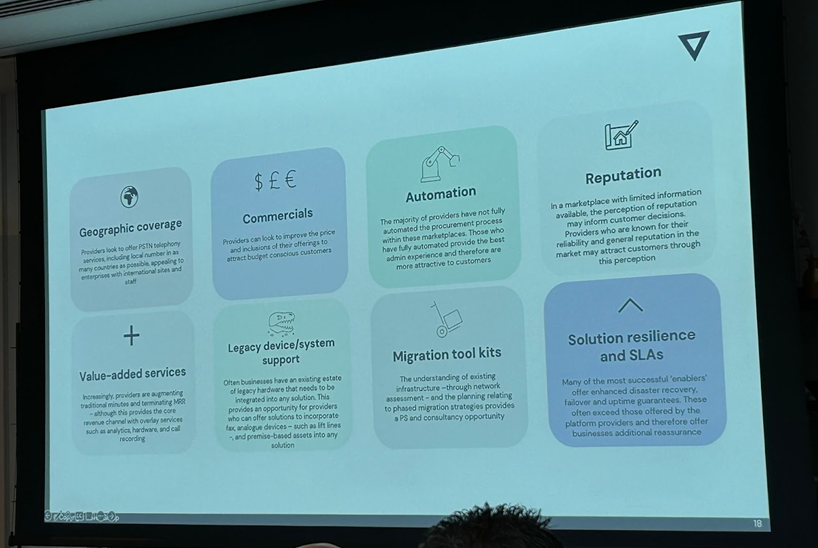

Finally, the conference highlighted the need for operators to differentiate based on brand strength and adapt to local markets, as each country has unique requirements. The communication landscape is rapidly evolving, with email becoming less favored and a greater reliance on UC tools for internal communication. Embracing this trend will require operators to adopt an ecosystem approach with partners solving a number of points in relation to:

Commercials

Geographic coverage

Migration tool kits

Solution resilience and SLAs

Value-added services

Legacy device/system support

Poll of the room

A poll of the attendees showed a majority considered that service providers would need to offer at least two UC platforms to their customer base. It is also worth noting that at least half the people in the room were from the Service Provider community.

This fits in neatly with the Netaxis strategy with their Fusion product of making it easy to support multiple UC offerings using the same IT system.

Conclusion

In conclusion, the Cavell Conference shed light on the dynamic nature of the UC market, emphasizing the importance of innovation, adaptation, and the strategic use of cloud services in staying relevant in this fast-paced industry.